OzTam ratings 2022: Seven retains total audience crown, while Nine keeps key demos

After a close TV ratings year, Mumbrella's Emma Shepherd sits down with the TV execs to discuss what it really means to take the ratings crown, the continuation of the measurement debate, and how each network's advertising bookings are tracking for 2023.

Seven has retained the title of Australia’s #1 television network and achieved the strongest free-to-air commercial audience share growth of any network this year, after being edged out by Nine in 2019 and 2020.

According to OzTam data, Seven finished the 2022 ratings year with a 39.1% share of the linear TV commercial total people audience, ahead of Nine at 38.6%, and Ten at 22.2%. The ratings year excludes the Easter holidays but did, however, include the Australian Open.

Seven West Media managing director and chief executive officer, James Warburton, tells Mumbrella what it really means for the network to take the TV ratings crown.

“Seven is Australia’s most-watched TV network, delivering audiences in 2022 to win the survey year both nationally and in the capital cities. We are #1 nationally, #1 metro, #1 regionally, #1 in total television – no matter how you cut it,” he says.

“When you talk about the TV ratings crown, going right back as early as I can remember, it’s about who is the most watched network,” explains Warburton. “And, you can break that into a whole number of demographics, and you can break it into any way you want. The big point which matters the most to shareholders more than anything else is who wins revenue.”

“If you look at FY22, we were number one in total television, metro, regional, and digital,” he notes. “If you look at the start, then of this next fiscal year, July, August, September, and these are all audited results by KPMG, we were number one in metro revenue, we were number one in regional net revenue, and we were number one in total television.”

In the capital cities, the Seven Network has grown its audience shares in total people, 25 to 54s and 16 to 39s during 2022. Seven also dominated all key audience demographics in regional markets, ranking #1 in total people, 25 to 54s and 16 to 39s.

7plus has also streamed 10.6 billion minutes and increased its audience by 16% year-on-year in BVOD and 41% in live streaming.

Seven’s chief content officer, of entertainment programming, Angus Ross, commented: “Our successful schedule in 2022 has created momentum that will continue into next year with an unbeatable content line-up of the best news, sport, drama, entertainment and special events that will inform, engage and entertain the nation.

“On 15 January 2023, we will also reveal the most exciting new channel launched in Australia in years, 7Bravo, bringing the very best of NBCUniversal’s extraordinary reality and true crime content to all Australians, live and free. The arrival of 7Bravo means that our dominant line-up of multichannel’s will become even stronger.”

Seven chief revenue officer, Kurt Burnette, said: “We have a clear strategy for continued growth in content, audience and technology. With that in mind, Seven has been building for something special over the course of 2022 into 2023 and beyond.

“This year was a winning year for Seven as the most-watched network. Our content and innovation plans for 2023 are electric. They include five new massive tentpole programs, new cultural sporting events to stop the nation, a brand new linear and live-streamed channel with thousands of hours of new BVOD content, and 7NEWS leading nationwide. They will all help to create growth for partners in a trusted, easy and brand-safe way.

“While our streaming numbers continue to soar and offer enormous opportunity for advertisers, it will be the combination with the powerful linear TV audience in a converged approach that will play a key part in advertiser success. Total TV is still unquestionably the most powerful way to reach Australians at scale and with Seven it will only get bigger next year,” he said.

When probed about measurement, Warburton states there is no other way to look at it, but that Seven has won this year’s TV ratings and revenue.

“Nine has only ever won the revenue on the back of being number one in total people, which obviously they did for two years. So, in getting back to the total people win, we’ve been able to get back to being the number one position in revenue,” he says. On week one, before the survey week period, we won 29 nationally, and we won 21 out of 40 metros. No matter how you cut it, Nine has always tried to cut it in a different way and exclude this and include that and everything else. Nine have had a good year, especially with the Australian Open, but ultimately, across the course of the year, we’ve beaten them into that number one spot in total people and revenue.”

As for the network’s multichannels, Warburton says, 7mate, 7TWO, and 7flix are doing about a 13% commercial share of all audiences.

“That’s the equivalent of Network Ten’s primary channel across this period. Ten has completely collapsed. This year, I think that’s clear for everyone to see,” he says. This year they’ll [Ten] be beaten by the ABC, which is the first time since records have been kept. So, the fourth, not third.”

Speaking on the broadcaster’s close competition with Nine, Warburton notes: “No matter how you cut it, if you just look at the metro, and Nine will tell you they win the demographics, the gap is negligible.

“They don’t mean total people. They won’t win any of the sunrise or the news arguments or any of those things. The AFL is dominant, versus the NRL. They don’t have the number one drama show. They don’t have the number one reality show.”

After pushing the network’s national success, and what percentage of clients are buying on a national basis, Warburton shares: “I think that for the vast majority of television advertisers, there’s very few that I need by metro.

“Done by region, the vast majority of the major advertisers like Harvey Norman or Toyota, or Unilever or any of the big FMCG clients, if you look at them, they buy metro and regional television. I would guess that it would be well in excess of 90% of all major clients that are watching it. Buying Metro and regional.”

As for how the network’s advertising bookings are tracking for 2023, Warburton adds: “It’s pretty early, we obviously gave a trading update at the AGM, sort of in relation to the market. We’ve been delaying a few of our negotiations.

“I’m not sure if you’ve seen the reprocessing of data coming through from OzTAM, but that was sort of 94 days where we were under-reported quite significantly, that data came through on Monday, and we’ve been able to crunch that and then really start from that perspective. So, it’s probably a bit early to tell at this point. We’re into a pretty hefty period of negotiations now. Which will start to get a flavour of how much of the book we write for next year before Christmas.”

Demographics are key for Nine

Meanwhile, over at Nine, the network has said its retained its coveted status as Australia’s #1 network within key advertising demographics.

Nine’s chief sales officer, Michael Stephenson, tells Mumbrella: “So, who is the winner? Well, the winner is the network that delivers the highest audience share in the demographics from the 1st of January through until the end of the year. That’s what advertisers buy.

“That’s what people care about and that’s what of course we’ve been obsessed with and focused on for the last seven years,” he says. “And that’s sort of that very clear strategy – around delivering the demos from the 1st of January through the year, right to the end of the year – that has allowed us to be the leading network. Whichever way you want to cut it for the fourth year in a row. And that’s something that we’re really proud of. That comes with a lot of hard work.

“We create amazing local content that clearly resonates with audiences and the higher our audience, the more we’ll be able to monetise that audience. And that’s of course what we are here to do.”

With the conclusion of the 2022 ratings survey period overnight, Nine ranked a dominant No. 1 with People 25-54, 16-39 and Grocery Shopper + Child.

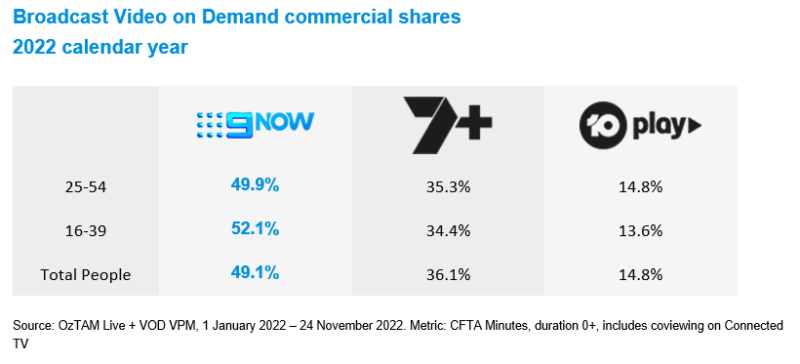

Taking a closer look at broadcast-video-on-demand (BVOD), 9Now came out on top with a commercial share of 49.1% in total people. 7plus took an overall BVOD commercial share of 36.1% and Ten finished up with a share of 14.8%.

Nine says 9Now Australia’s No.1 commercial free-to-air BVOD platform with all key demographics, and across the calendar year, 9Now recorded 15.5 billion Live + VOD minutes – a year-on-year increase of 19%.

In addition, the broadcaster says live streaming on 9Now has also driven a huge increase with 7.8 billion live minutes streamed in 2022 to date – a year-on-year increase of 51%, and across the calendar year, 9Now has recorded 15.5 billion Live + VOD minutes – a year-on-year increase of 19%.

Moreover, live streaming on 9Now has driven a huge increase with 7.8 billion live minutes streamed in 2022 to date – a year-on-year increase of 51%.

In 2022, Nine can lay claim to the highest rating program of the year with the Australian Open Women’s Final – Presentation recording a Total TV audience of 4.1 million. It was the highest rating Australian Open Women’s Final of all time and recorded the highest live BVOD audience of the Australian Open ever, with 241,000 people tuning in on 9Now.

The network’s broadcast of the Men’s Final of the Australian Open achieved a national Total TV average audience of 2.3 million. It was the highest rated Men’s Final in four years. On 9Now, the Men’s Final recorded a Live BVOD Audience of 227,000 – a year-on-year increase of 157% and the highest live BVOD Audience of an Australian Open Men’s Final ever.

That surpasses a 65.8% share for the 2021 primetime AFL Grand Final and a 56% share for the Tokyo Olympics Opening Ceremony.

The Block-Winner Announced was the highest-rating non-sports program of the year with a Total TV audience of 2.664 million.

As for measurement, Stephenson says: “We look forward to the launch of Virtual Oz. That will be a game changer for total television because you’ll be able to measure free-to-air TV and BVOD from one source of data, which will be amazing for advertisers and agency folk.

“Right now though, OzTAM measures metropolitan FTA, Reg TAM measures regional television and OzTAM also measures BVOD. So, they’re all separate which is why we look at it that way. Now, if others want to add them together and do whatever else, then that would be up to them. We’re obviously not until such time as the measurement supports that.”

As for how forward bookings are looking for next year, Stephenson notes that it is still early days.

“We’re not naïve to think that the environment in which we operate does have some headwinds,” he says. “I’m optimistic by nature and what we can certainly see in the first quarter you can see the real strength in Australia, which looks fantastic, but has a full deck of partners, sponsors and our first serve advertising partners through the Australian Open. They’ll be accessing our content across all platforms or screens. So we’re seeing huge demand for that. So as we stand here today and the visibility that I have, I’m feeling pretty good about it.”

Ten still the one for youth audiences

Over at Ten, the network remained the youngest free-to-air television network in Australia and boasts more of the top entertainment shows in key advertising demographics than its competitors.

Paramount Australia and New Zealand chief sales officer, Rod Prosser tells Mumbrella: “Paramount continues to deliver best-in-class, consistent, brand-safe, premium integrations for advertisers across all our platforms, supercharged with several unique opportunities for advertisers and sponsors including a myriad of new offerings on 10 Play.

“The future of audience consumption spans across all screens, making total content measurement and monetisation more important than ever for a world-leading entertainment company such as Paramount.

“This year we’ve cemented our position as industry leaders in advertising innovation with our suite of next-generation ad products and strategic partnerships including KERV Interactive, Samba TV, Magnite, Innovid plus BrandBOOST and AdSelector.”

The network reached 11.9 million exclusive and elusive sport viewers across the year. The 2022 Melbourne Cup Carnival reached 3.51 million Australians, the Australian Formula One Grand Prix reached 3.2 million Australians, while the A-Leagues reached over 6.5 million fans.

The network says 10 Play had its biggest year yet, up 6% year-on-year, with more than 6.2 million registered users. In addition to more exclusive content being added to the platform, 10 Play has seen enormous growth in live streaming, up 21% on the same point of 2021.

“We had the number one new show in 2022 which was Hunted, which really delivered something quite unique and different. And was quite compelling. And obviously, hence became the number one show. So first and foremost, we’re really pleased with that format, and the fact that we took a risk on a new format like that, and then paid off,” Prosser says.

However, Ten Network’s prime-time audience share in metropolitan markets fell below that of the ABC, at just 16.4 per cent.

Have your say