Weeks after the Boston Celtics won the 2023–24 NBA championship, owner Wyc Grousbeck announced that the team was up for sale. Grousbeck was clearly selling as high as he possibly could, on the heels of a new owner-friendly CBA and a title, and ahead of whatever massive economic turmoil caused by the second Donald Trump administration. While the Celtics were going to fetch more than the then-record $4 billion Mat Ishbia paid for the Phoenix Suns in 2022, I was still surprised to see the eventual purchase price, announced Thursday morning: A group led by Bill Chisholm agreed to pay Grousbeck $6.1 billion, and will take over after the 2027–28 season.

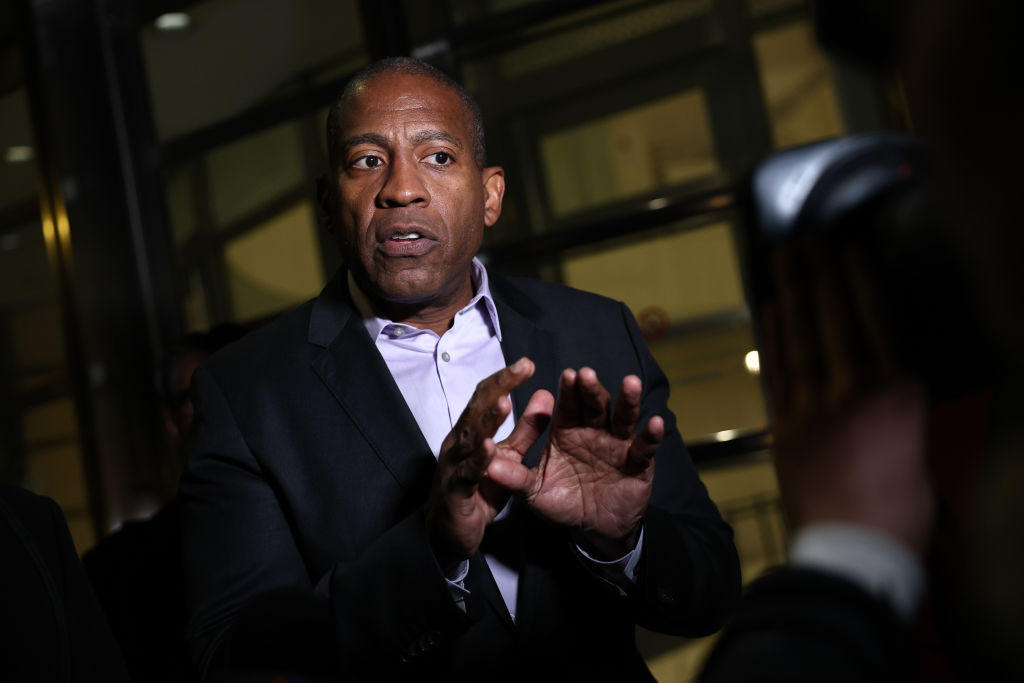

That sum represents a seventeenfold increase on the price that Grousbeck and his co-owners paid in 2002, an exospheric leap that makes one wonder who exactly can afford to pay roughly the GDP of Sierra Leone for ownership of a sports team. Chisholm runs Symphony Technology Group, a private equity firm dedicated to hoovering up and degrading tech companies. In this sense, he's the perfect owner for a sports team based in Boston, a hub for private equity firms both competent and incompetent, and he epitomizes the new ownership class that will gradually take over from an extant crop of owners who may soon look to sell into such a frothy market.

Since Vivek Ranadive's group bought a majority of the Kings for a paltry $534 million in 2013, just over one-third of the NBA has turned over, and every subsequent sale has eclipsed the $1 billion mark. Let us consider how those 11 principal owners made their money: Steve Ballmer (Clippers), Joe Tsai (Nets), and Ryan Smith (Jazz) are tech guys; the Fertittas (Rockets) and Adelsons (Mavericks) are casino families; and Ishbia oversees an exploitative mortgage company. (The incoming Timberwolves group is weird, and its money comes from a combination of e-commerce, tech, and Michael Bloomberg, though the initial deal they struck with outgoing owner Glen Taylor was funded by a private equity firm closely associated with the Bin Laden family.) The Hornets, Hawks, Bucks, and now Celtics are owned by people who made their money in private equity. One imagines that this cohort, which also includes Pistons owner Tom Gores and 76ers owner Josh Harris, will necessarily grow in the years to come.

There are two reasons to expect such an increase. First, private equity is growing, both in absolute terms and relative to the broader economy, with the market expected to essentially triple from $540 billion in 2024 to $1.3 trillion by 2034. For an example of what that looks like in practice, several major American private equity firms are already lining up to take charge of redeveloping Ukraine, swapping out Russian ballistic weaponry for American economic weaponry in the process.

Second, ballooning sale prices will restrict access to the very highest tier of rich person. While the Blazers or any potential expansion franchise won't cost $6 billion, and while some real-estate and tech-industry rich guys will be able continue buying into the NBA, the trend is undeniable and will necessarily continue. What sort of one-percenter can afford to buy a sports team for several billions of dollars? By the numbers, it's either private-equity billionaires, or, if Adam Silver is able to conduct the necessary diplomacy, sovereign wealth funds. We'll get answers there, as the NBA reportedly wanted to get the Celtics' situation figured out before it allots expansion slots.

Sport ownerships defies so many of the rational maxims that apply to other swaths of the economy, as both the scarcity of NBA franchises and their extremely public-facing nature have thus far kept the parasitic bloodsucking endemic to private equity operations out of the ownership dynamic. Rather than the Celtics getting stripped for parts like a digital media shop or retail chain—I can dream!—what fans likely can expect is an ownership class that conducts its relationship with labor even more ruthlessly.

This current CBA will expire in six years, which is not a long time. When the time comes to negotiate its replacement, we'll see what effect the new ownership class has on the game.