Asia Week Ahead: Inflation For China And Taiwan, Plus Key Data On Japan And Korea, And Interest Rate Decision For Philippines

Image Source: Unsplash

China’s deflation challenge is the main event as Beijing releases both consumer price and producer price indices. Taiwan's inflation rate is expected to rebound, while Japan reports labour cash earnings and South Korea releases its jobless rate for March. The Bangko Sentral ng Pilipinas (BSP) is expected to cut its policy rate by 25bp.

China: low inflation should enable the PBoC to cut rates

March inflation data will be released Thursday. High-frequency price data suggests the consumer price index (CPI) remained soft in March, with the headline near the zero bound. We look for a small CPI uptick of 0.1% year on year. On the other hand, producer price index (PPI) inflation is likely to remain in negative territory for a 30th consecutive month as the majority of input costs fall. Deflationary pressure and still-high real interest rates should give the People’s Bank of China (PBoC) room to cut rates. So far, it's held off acting until a suitable timing window presents itself.

Taiwan: inflation and trade data

Taiwan publishes its CPI inflation on Tuesday, when we expect a rebound to 1.9% YoY. That’s broadly in line with the 2% inflation target. Inflationary pressures look likely to ease a little as the impact of last year’s electricity price hikes is absorbed. Growth momentum, meanwhile, looks to be moderating. The central bank remained on hold in March, but signalled it would adjust policy if necessary. We are still a ways off, though, and much could change between now and then. Factors currently point to no action once again at the June meeting.

On Thursday, Taiwan publishes March trade data. We look for trade growth to come back to earth after a Lunar New Year-skewed February. Nonetheless, we’re looking for export and import growth to stay relatively solid at 11.3% YoY and 19.1% YoY, respectively. This will amount to a trade surplus of around $7.1bn.

Japan: wages expected to gradually improve

Labour cash earnings are expected to accelerate amid solid bonus gains in February. Yet, real cash earnings should continue to contract after inflation peaked that same month. Inflation eased in March thanks to energy subsidies and cooling fresh food prices. As such, we believe a gradual improvement in wages should continue going forward.

South Korea: weak private sector employment

The jobless rate is expected to stay at 2.7% in March. Government job programmes should increase employment, mostly in social work and health. Yet hiring in construction and other major private sector categories is likely to decline.

Philippines: BSP likely to cut its key rate

The Bangko Sentral ng Pilipinas' (BSP) decision to pause its rate-cutting cycle in February was unexpected. We believe this was primarily due to "unusual" global uncertainties rather than domestic fundamentals. The timing of the rate cuts is expected to be more gradual and measured than previously anticipated, influenced in part by the Federal Reserve's actions. However, we still foresee three additional rate cuts of 25bp each. The first likely coming this week following an unexpected February drop in CPI inflation.

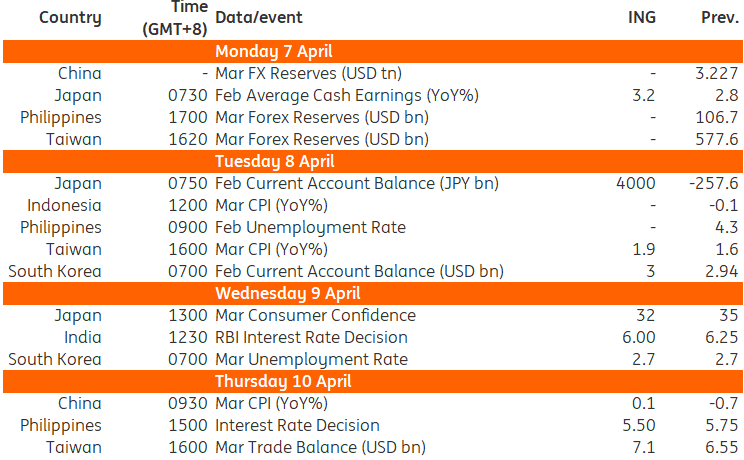

Key events in Asia next week

Source: Refinitiv, ING

More By This Author:

Tariffs On, Risk Off: Credit Set To LeakTurkey Sees Benign Inflation In March, But Upside Risks For April

FX Daily: Without Domestic Support, Dollar Is Left A Little Naked

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more