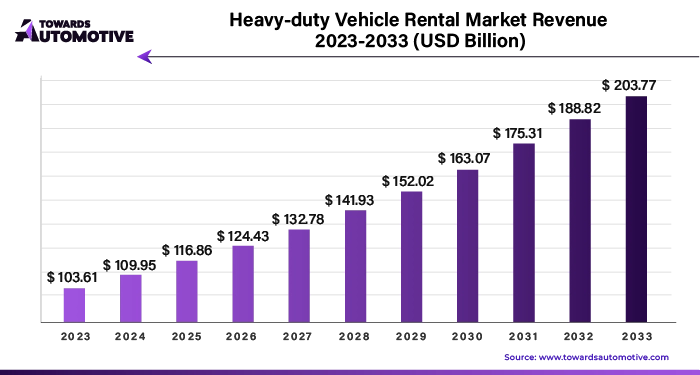

Heavy-duty Vehicle Rental Market Size to Reach USD 203.77 Bn by 2033

The global heavy-duty vehicle rental market size is calculated at USD 109.95 billion in 2024 and is expected to reach around USD 203.77 billion by 2033, growing at a solid CAGR of 7.10% between 2024 and 2033.

/EIN News/ -- Ottawa, July 16, 2024 (GLOBE NEWSWIRE) -- The global heavy-duty vehicle rental market size is predicted to grow from USD 103.61 billion in 2023 to approximately USD 203.77 billion by 2033, according to a study published by Towards Automotive a sister firm of Precedence Statistics.

For the short version of this report @ https://www.towardsautomotive.com/insight-sample/1296

The heavy-duty vehicle rental market stands as a critical sector within the broader transportation and logistics industry, offering businesses and individuals flexible access to essential commercial vehicles without the burden of ownership. The heavy-duty vehicle rental market includes a wide array of commercial vehicles, including trucks, trailers, buses, and specialized equipment, rented or leased for short to medium-term periods. These vehicles cater to various industries such as logistics, construction, manufacturing, agriculture, and infrastructure development.

Economic fluctuations create demand variability, prompting businesses to opt for rental solutions over ownership for flexibility and cost efficiency. Technological advancements such as telematics and electric vehicle integration, enhance operational efficiency and align with sustainability goals, stimulating market growth. Additionally, urbanization and infrastructure development projects augment the demand for heavy-duty vehicles, particularly in emerging markets.

You can place an order or ask any questions, please feel free to contact us at sales@towardsautomotive.com

Key Trends and Findings

- Environmental consciousness is driving a shift towards eco-friendly transportation solutions within the heavy-duty vehicle rental market. Rental companies are increasingly adopting electric and alternative fuel vehicles, investing in renewable energy infrastructure, and implementing carbon offsetting initiatives.

- Rapid advancements in technology, including telematics, GPS tracking, and fleet management software, are revolutionizing the heavy-duty vehicle rental industry.

- The emergence of autonomous and semi-autonomous vehicle technologies holds the potential to transform the heavy-duty vehicle rental market. While still in the early stages of development and deployment, these technologies promise to enhance safety, efficiency, and productivity.

- The heavy-duty vehicle rental market in North America is characterized by robust demand driven by the region's thriving logistics, construction, and industrial sectors. Major players such as Ryder System and Penske Truck Rental dominate the market, offering a wide range of rental solutions to businesses of all sizes.

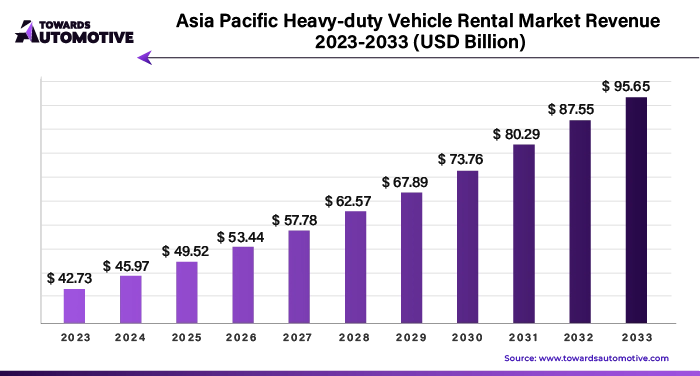

- The Asia-Pacific region's heavy-duty vehicle rental market is experiencing rapid growth fueled by robust economic development, urbanization, and infrastructure projects. China, India, and Southeast Asian countries are key growth drivers, with a growing demand for logistics and construction services.

Get exactly what you need with a bespoke report! Request Now: https://www.towardsautomotive.com/contact-us

Market Drivers

Growth of E-commerce Industry

The exponential growth of the e-commerce industry is a significant driver fueling demand in the heavy-duty vehicle rental market. As online retail continues to expand globally, the need for efficient transportation and logistics solutions becomes increasingly paramount. Heavy-duty vehicles play a crucial role in facilitating the movement of goods from warehouses to distribution centers and ultimately to the end consumer.

According to the estimates by U.S. Census Bureau of the Department of Commerce, the U.S. retail e-commerce sales in the fourth quarter of 2023 stood at $285.2 billion, reflecting a modest 0.8 percent rise (±1.1%) from the preceding quarter of 2023. Compared to the fourth quarter of 2022, e-commerce sales in the same period of 2023 saw a notable uptick of 7.5 percent (±1.2%). Notably, e-commerce transactions in the fourth quarter of 2023 constituted 15.6 percent of the total sales.

Rental companies are witnessing a surge in demand for their services as e-commerce businesses require flexible and scalable transportation options to manage fluctuating order volumes, seasonal peaks, and last-mile deliveries. The rapid growth of e-commerce has also led to the emergence of specialized logistics providers and delivery services, further driving demand for heavy-duty vehicle rentals.

Cost Efficiency Advantage

Cost efficiency is a significant driver propelling the heavy-duty vehicle rental market during the forecast period. Opting to rent heavy-duty vehicles presents businesses with a multitude of cost advantages compared to ownership, particularly for short-term or project-based requirements. By choosing to rent instead of purchasing, companies can sidestep the substantial upfront capital investment typically associated with acquiring a fleet of heavy-duty vehicles. Thus, the cost-efficient nature of heavy-duty vehicle rentals not only enhances financial performance but also enables businesses to adapt swiftly to changing market dynamics and capitalize on emerging opportunities without being burdened by long-term ownership commitments.

Market Restraints

Capital Intensity

Acquiring and managing a diverse fleet of heavy-duty vehicles necessitates substantial capital investment, which can present a formidable obstacle for new entrants and smaller rental firms. The upfront costs associated with purchasing or leasing vehicles, along with expenses for insurance, licensing, and facility maintenance, can strain financial resources and limit scalability. Moreover, heavy-duty vehicles often require significant on-going investment for upgrades, repairs, and fleet expansion, further amplifying the capital intensity of the business. This capital-intensive nature of the heavy-duty vehicle rental market can hinder the growth and competitiveness of smaller players, constraining market entry and expansion opportunities.

Maintenance Costs

Ensuring the proper maintenance and upkeep of rental vehicles is imperative to uphold reliability, safety, and customer satisfaction. However, maintenance costs represent a substantial expenditure for rental companies, particularly for aging fleets or specialized equipment requiring specialized servicing. Regular inspections, repairs, and replacements of vehicle components, such as tires, brakes, and engines, can incur significant expenses and impact profitability. Moreover, unexpected breakdowns or mechanical issues can disrupt operations, lead to downtime, and result in additional repair costs and loss of revenue. As such, managing maintenance costs effectively is essential for rental companies to maintain fleet reliability, minimize downtime, and preserve profitability amidst competitive pressures.

Market Opportunities

Increasing Focus on Sustainability through Adoption of Eco-Friendly Vehicles

The growing emphasis on environmental sustainability presents a significant opportunity for the heavy-duty vehicle rental market. Increasing awareness of climate change and pollution prompts a shift towards eco-friendly transportation solutions, including electric, and renewable energy-powered vehicles. This transition is bolstered by government incentives, such as tax credits and subsidies, aimed at promoting the adoption of sustainable technologies.

- In September 2022, the Iveco Group unveiled the establishment of GATE (Green & Advanced Transport Ecosystem), introducing a novel, comprehensive rental model tailored for electric trucks and vans, thereby bolstering the industry's shift towards sustainable energy. This new entity will deliver an extensive service framework grounded on a pay-per-use structure, granting customers access to cutting-edge propulsion technology. Encompassing a diverse array of zero-emission vehicles, ranging from last-mile delivery to long-distance haulage, GATE signifies a significant step towards fostering environmentally conscious transportation solutions.

- In April 2022, JBS introduced No Carbon, a novel venture focusing on the rental of 100% electric trucks. This initiative aligns with the company's pledge to reach net-zero emissions by 2040. Operating under JBS Novos Negócios, the new company will oversee the management of a fleet comprising electric-powered refrigerated trucks.

Furthermore, on-going infrastructure development, such as the expansion of charging stations and alternative fuel infrastructure, facilitates the integration of eco-friendly vehicles into rental fleets. With sustainable solutions, rental companies can not only meet growing customer demand for environmentally conscious transportation but also align with regulatory requirements and contribute to a greener, more sustainable future.

Key Segment Analysis

Type Segment Analysis Preview

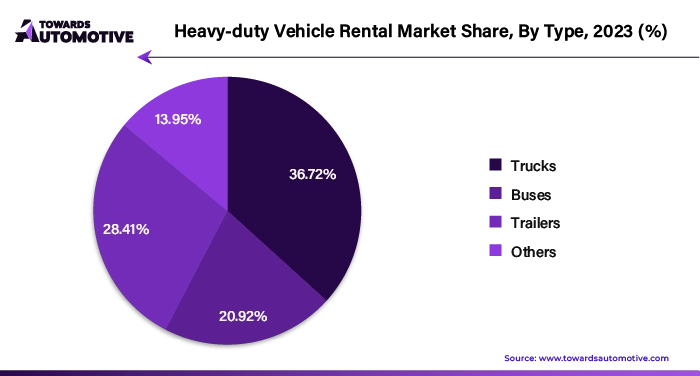

The trucks segment captured a substantial market share of 36.72% in 2023. The versatile nature of trucks makes them indispensable across various industries, including logistics, construction, agriculture, and manufacturing. Their ability to transport heavy loads over long distances efficiently contributes to their widespread use and demand. Additionally, the growing e-commerce industry and increasing urbanization have heightened the need for transportation services, further fueling the demand for trucks.

Asset Alliance, a British truck rental company, placed an order for 1,500 new trucks from the Dutch manufacturer. While the majority of the trucks are diesel-powered, at least 75 of them will be electric. These electric trucks belong to the latest lineup of DAF vehicles, including the XF, X.G., and XG+ models, offering a range of up to 500 kilometers.

Propulsion Segment Analysis Preview

The ICE segment held largest market share of 87.93% in 2023. The widespread availability and established infrastructure supporting ICE vehicles have contributed to their market dominance. With a robust network of fueling stations and familiarity among consumers and businesses, ICE vehicles have remained the preferred choice for transportation needs. Additionally, the relatively lower upfront costs and longer driving ranges offered by ICE vehicles make them more accessible and practical for many users.

Regional Insights

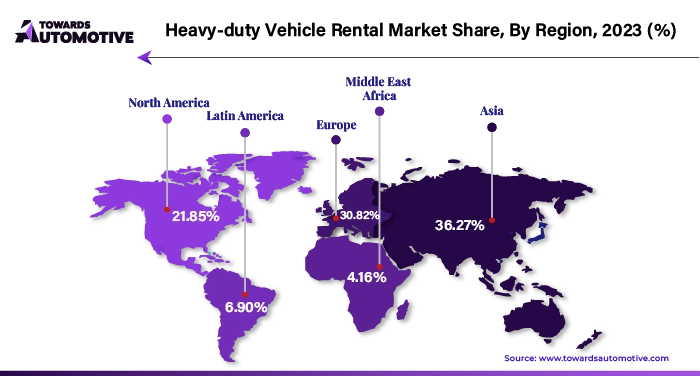

Asia Pacific dominated the market with 41.24% of shares in the global heavy-duty vehicle rental market. The growing e-commerce industry and expanding logistics sector in the Asia Pacific region drive demand for heavy-duty vehicle rentals. With the rise of online shopping and delivery services, there is a growing need for trucks, vans, and specialized vehicles for last-mile delivery, warehousing, and distribution operations. Furthermore, rapid urbanization and infrastructure development in countries like China, India, and Southeast Asian nations create demand for heavy-duty vehicles for construction, road building, and urban transportation projects. Rental companies are important in providing equipment and vehicles for infrastructure development, benefiting from the increasing demand for rental services.

North America is expected to grow at a considerable CAGR of 6.60% during the forecast period. The region's robust economy drives demand across various sectors such as construction, transportation, logistics, and manufacturing, creating a steady need for heavy-duty vehicles. Furthermore, the reliance on trucking for freight transportation, coupled with the growth of e-commerce and retail sectors, contributes to the sustained demand for heavy-duty trucks, vans, and trailers for transportation and logistics operations. Additionally, fleet modernization efforts by operators and the adoption of advanced vehicle technologies contribute to the growth of the rental market as companies seek to upgrade their fleets with newer and more efficient models.

Recent Developments by Key Market Players

- February, 2024: Flexter.com unveiled a strategic alliance with Green Motion/U-Save, marking a significant milestone in the rental industry. Under this collaboration, Green Motion's globally recognized brand, including its prominent U-Save brand in the USA, will feature its extensive truck rental inventory on the Flexter.com platform. The primary objective of this partnership is to revolutionize the accessibility and convenience of short-term truck rentals on a global scale.

- October, 2023: Penske Truck Leasing expanded its fleet by incorporating Xos, Inc. battery-electric trucks, signaling a shift towards sustainable transportation solutions. Penske intends to deploy these trucks across multiple industries to meet diverse customer needs. Specifically, the Xos Stepvan, a Class 6 vehicle precisely designed for commercial applications, will serve various operational requirements.

- July, 2022: Big Truck Rental (BTR) made waves in the industry with the launch of its innovative rental program, BTR’s Complete Fleet. Crafted with a focus on addressing business requirements, BTR’s Complete Fleet represents a strategic capital and fleet management strategy tailored to meet the evolving needs of the modern collection environment. Offering unmatched flexibility, the Complete Fleet program provides waste haulers and municipalities with immediate access to like-new trucks on a recurring or on-going basis, ensuring seamless operations without service disruptions or burdensome maintenance costs.

- May, 2022: Penske Truck Leasing furthered its commitment to sustainability by integrating Orange EV electric terminal trucks into its operations across the U.S. These specialized vehicles are designed for trailer-handling operations in truck yards, warehousing and distribution centers, container terminals, and similar facilities where short-distance mobility is essential.

Browse More Insight in Towards Automotive:

- The automotive fault circuit controller market size was projected at USD 1.85 billion in 2022 and is expected to reach USD 6.33 billion in 2032, increasing at CAGR of 11.92% from 2023 to 2032.

- The automotive torque converter market size to rise from USD 3.72 billion in 2023 to reach USD 6.11 billion by 2032, increasing at CAGR above 5.56% between 2023 and 2032.

- The automotive gears market size to rise from USD 5.79 billion in 2023 and is predicted to hit USD 10.27 billion by 2032, expanding at 6.58% CAGR during the forecast period.

- The high-performance trucks market size was valued at USD 76.68 billion in 2023 and is expected to reach USD 110.48 billion by 2032, registering a CAGR above 4.14% during the forecast period.

- The automotive fuel tank market size was valued at USD 25.08 billion in 2023 is projected to reach USD 38.04 billion by 2032, expanding at CAGR of 4.74% during the forecast period.

- The automotive front-end module market size was valued at USD 147.69 billion in 2023 and is expected to reach USD 226.29 billion by 2032 registering a CAGR of above 4.86% during the forecast period.

- The automotive fuel filter market size was valued at USD 3.43 billion in the year 2023 and is expected to reach USD 5.54 billion in the year 2032 while registering a CAGR above 5.46% during the forecast period.

- The x-by-wire system market size to surge from USD 300 million in 2023 and is predicted to hit USD 5025 million by 2032, growing at a CAGR of 36.77% from 2023 to 2032.

- The market value of automotive Tire Pressure Monitoring Systems (TPMS) to rise from USD 8.38 billion in 2022 and anticipated to reach USD 23.52 billion by 2032, with a CAGR of 10.10% during the forecast period.

- The heavy-duty tire market size reached a value of USD 26.28 billion in 2022 and is projected to reach USD 36.83 billion by 2032, with a compound annual growth rate (CAGR) of 3.37% during the forecast period.

Market Companies

Some of the key players in heavy-duty vehicle rental market are Penske Truck Leasing, Ryder System, Inc., Enterprise Holdings, Inc. (Enterprise Truck Rental), Herc Holdings Inc. (Herc Rentals), United Rentals, Inc., The Hertz Corporation (Hertz Equipment Rental Corporation), Sunbelt Rentals, Big Truck Rental, Sixt S.E., and Premier Truck Rental, among others.

Market Segments

By Type

- Trucks

- Buses

- Trailers

- Others

By Propulsion

- ICE

- Electric

By Service Provider

- OEM

- Third Party Companies

By Rental Type

- Short Term

- Long Term

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- U.K.

- France

- Germany

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-East Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of Middle East & Africa

Acquire our comprehensive analysis today @ https://www.towardsautomotive.com/price/1296

You can place an order or ask any questions, please feel free to contact us at sales@towardsautomotive.com

Subscribe to our Annual Membership and gain access to the latest insights and statistics in the automotive industry. Stay updated on automotive industry segmentation with detailed reports, market trends, and expert analysis tailored to your needs. Stay ahead of the competition with valuable resources and strategic recommendations. Join today to unlock a wealth of knowledge and opportunities in the dynamic world of automotive: Get a Subscription

About Us

Towards Automotive is a premier research firm specializing in the automotive industry. Our experienced team provides comprehensive reports on market trends, technology, and consumer behaviour. We offer tailored research services for global corporations and start-ups, helping them navigate the complex automotive landscape. With a focus on accuracy and integrity, we empower clients with data-driven insights to make informed decisions and stay competitive. Join us on this revolutionary journey as we work together as a strategic partner to reinvent your success in this ever-changing packaging world.

Browse our Brand-New Journals:

https://www.towardspackaging.com

https://www.towardshealthcare.com

https://www.precedenceresearch.com

For Latest Update Follow Us: https://www.linkedin.com/company/towards-automotive

EIN Presswire does not exercise editorial control over third-party content provided, uploaded, published, or distributed by users of EIN Presswire. We are a distributor, not a publisher, of 3rd party content. Such content may contain the views, opinions, statements, offers, and other material of the respective users, suppliers, participants, or authors.