Surety Market Size is Anticipated to Grow at a CAGR of 6.6%, Reaching USD 31.85 billion by 2031 | The Insight Partners

The US is a major market for surety bond providers in North America, and the market growth in the country is ascribed to associations such as the US Small Business Administration (SBA), an independent agency of the US government that provides support to entrepreneurs and small businesses.

/EIN News/ -- US & Canada, April 25, 2025 (GLOBE NEWSWIRE) -- According to a new comprehensive report from The Insight Partners, the surety market is observing significant growth owing to the need to restore the aging infrastructure and an increase in the adoption of public-private partnerships for infrastructure development.

The report runs an in-depth analysis of market trends, key players, and future opportunities. In general, the surety market includes a wide variety of bond types and end users that are expected to register strength in the coming years.

To explore the valuable insights in the Surety Market report, you can easily download a sample PDF of the report - https://www.theinsightpartners.com/sample/TIPRE00002849/

Overview of Report Findings

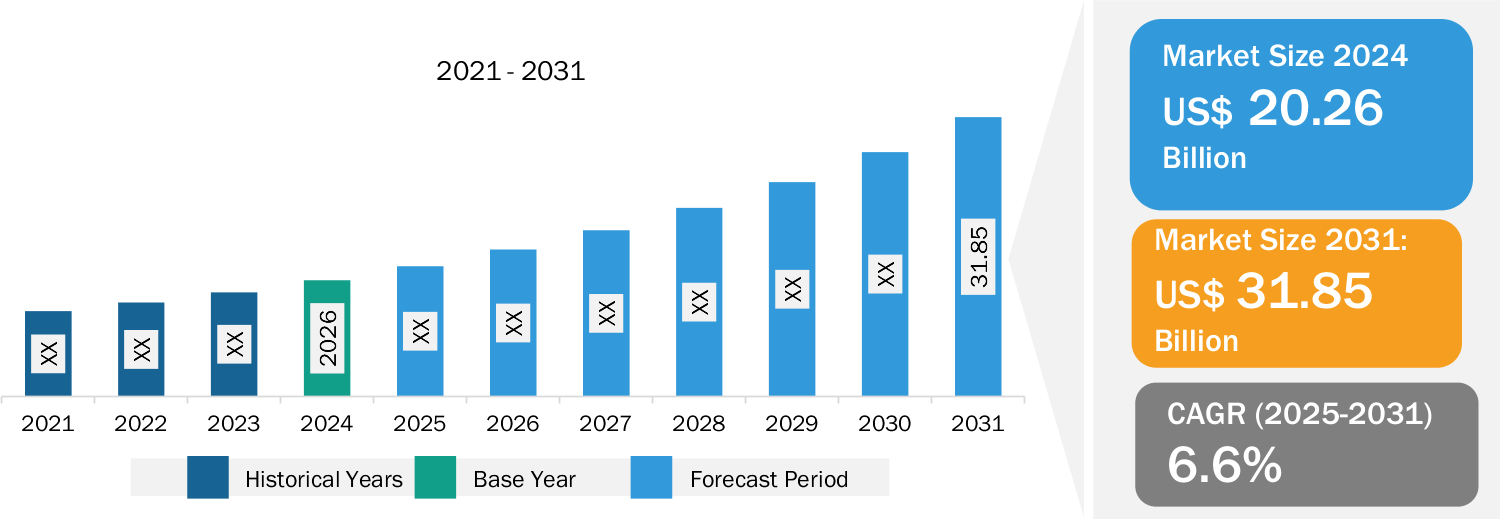

- Market Growth: The surety market was valued at US$ 20.26 billion in 2024 and is projected to reach US$ 31.85 billion by 2031; it is expected to register a CAGR of 6.6% during 2025-2031.

- Restoration of Aging Infrastructure: Many aging buildings and infrastructure worldwide require restoration. Across the globe, the aging power generation and distribution infrastructure are becoming key challenges for the utility sector. The countries are focused on establishing proper power generation and distribution infrastructure. As stated by the Smart Electric Power Alliance (SEPA) in September 2024, the aging infrastructure of the US power grid is a significant challenge as electricity demand rises and the transition to clean energy progresses. Investing in infrastructure and advanced grid technologies is essential to modernizing the power system and addressing changing energy requirements. Surety bonds are often required for projects that involve construction, repair, or upgrades to infrastructure, as they provide financial protection in case the contractor fails to meet the project requirements or obligations. As the percentage of aging infrastructure—such as road bridges and tunnels—increases, the need for contractors to carry out repair and modernization projects rises. This heightened level of infrastructure work leads to a greater demand for surety bonds, which guarantee that contractors will complete their work according to specifications and within budget.

- Technological Advancements: The use of advanced technologies enables surety bond providers to enhance risk management practices, improve customer engagement, and differentiate their offerings in a competitive marketplace. Surety companies are increasingly utilizing data analytics to assess risks more accurately. By analyzing financial data, past performance records, and project complexities, underwriters can make informed decisions about issuing bonds and setting premiums. The emergence of online platforms allows for streamlined application processes, faster turnaround times, and improved communication between contractors, project owners, and surety companies. AI has the potential to automate a few aspects of the underwriting process, such as preliminary risk assessments and data analysis. This can reduce the workload of underwriters, allowing them to focus on complex cases and client relationships. Also, digitalization enables surety providers to implement robust risk mitigation measures and fraud detection mechanisms to protect against potential losses. Advanced analytics tools can detect anomalies, identify suspicious activities, and flag high-risk transactions in real time, allowing providers to take proactive measures to mitigate risks and prevent fraudulent behavior. Thus, the rise in digitalization, automation, and other technological advancements is anticipated to fuel the surety market growth in the coming years.

Stay Updated on The Latest Surety Market Trends: https://www.theinsightpartners.com/sample/TIPRE00002849/

Market Segmentation

- Based on bond type, the surety market is segmented into contract surety bond, commercial surety bond, court surety bond, and fidelity surety bond. The contract surety bond segment dominated the market in 2024.

- Based on end users, the surety market is bifurcated into individuals and enterprises. The enterprises segment dominated the market in 2024.

Competitive Strategy and Development

- Key Players: Major companies operating in the surety market include Crum & Forster; CNA Financial Corp; The Travelers Companies Inc; Liberty Mutual Holding Co Inc; The Hartford Insurance Group, Inc.; Chubb Ltd; Credendo; Great American Insurance Company; Atradius NV; and IAT Insurance Group.

- Trending Topics: Group Health Insurance Market, Property and Casualty Insurance Market, and Trade Credit Insurance Market

Global Headlines on Surety Market

- Specialty property and casualty insurance carrier IAT Insurance Group selected CLARA Analytics Claims Document Intelligence Pro (Claims DocIntel Pro) as its newest AI platform to support its auto and general liability claims process.

- Amynta Group, a leading insurance services provider, announced the acquisition of the Credit Division of Crum & Forster (“C&F”), a subsidiary of Fairfax Financial Holdings Limited.

Purchase Premium Copy of Global Surety Market Size and Growth Report (2025-2031) at: https://www.theinsightpartners.com/buy/TIPRE00002849/

Conclusion

North America dominated the surety market in 2024, followed by Europe and Asia Pacific.

The surety market involves companies providing guarantees (surety bonds) that ensure contractual obligations are met, often in construction and government projects. It has grown steadily due to increased infrastructure development, regulatory requirements, and risk management awareness. Major players dominate with strong underwriting capabilities. Technological advancements and digital platforms are improving efficiency and accessibility. While North America leads the market, emerging economies are showing rising demand.

The SBA guarantees the bid, performance, and payment of surety bonds issued by certain surety companies. The necessity of surety bonds in export activities is likely to fuel the growth of the surety bond market in North American countries, as proper bonds need to be in place to avoid penalties, fines, and shipment delays. The surety market in the region is influenced by government decisions and local policies that expand the use of surety bonds in various sectors, particularly in real estate and land development. The market grows through increased participation from both local and international firms, enabling financial institutions to take on larger risks, expand their offerings, and strengthen their reinsurance strategies.

In Europe, government bodies are making significant investments in infrastructure projects, including transportation and energy infrastructure projects. Regulatory updates such as those in construction regulations, the economic need for public-private partnerships (PPPs), and regulatory frameworks promoting transparency and risk mitigation boost the demand for surety bonds across Europe. The market in Europe also benefits from continuous infrastructure developments. The increasing emphasis on risk management and regulatory compliance has spurred the demand for surety bonds across different sectors, including construction, real estate, and finance. Further, the flourishing housing construction industry in Europe provides a significant boost to the country's overall construction sector, in turn favoring the surety market growth.

The report from The Insight Partners, therefore, provides several stakeholders—including solution providers, system integrators, and end users —with valuable insights to successfully navigate this evolving market landscape and unlock new opportunities.

Trending Related Reports:

https://www.theinsightpartners.com/reports/financial-advisory-market

https://www.theinsightpartners.com/reports/digital-banking-platforms-market

https://www.theinsightpartners.com/reports/retail-core-banking-systems-market

About Us:

The Insight Partners is a one stop industry research provider of actionable intelligence. We help our clients in getting solutions to their research requirements through our syndicated and consulting research services. We specialize in industries such as Semiconductor and Electronics, Aerospace and Defense, Automotive and Transportation, Biotechnology, Healthcare IT, Manufacturing and Construction, Medical Device, Technology, Media and Telecommunications, Chemicals and Materials.

Contact Us:

If you have any queries about this report or if you would like further information, please contact us:

Contact Person: Ankit Mathur

E-mail: ankit.mathur@theinsightpartners.com

Phone: +1-646-491-9876

Press Release - https://www.theinsightpartners.com/pr/surety-market

Distribution channels: Banking, Finance & Investment Industry, Business & Economy, Media, Advertising & PR, Science ...

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release