The Evolution of Overboarding Policies

This article explores how and why companies, proxy advisory firms, and large institutional investors have in recent years tightened their approach to overboarding policies, which limit the number of publicly listed boards on which directors can serve.

Trusted Insights for What’s Ahead

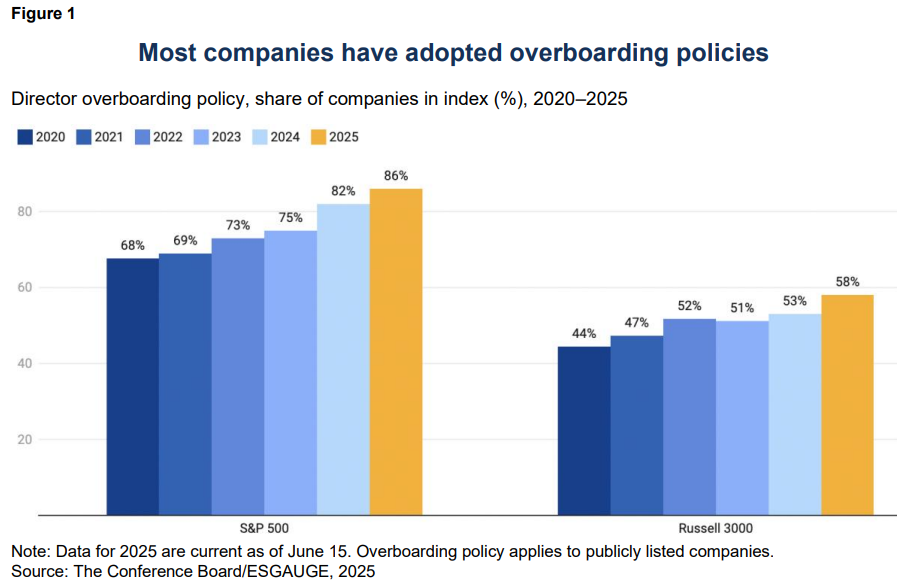

- In the S&P 500, disclosure of overboarding policies jumped from 68% in 2020 to 86% in 2025, reflecting investor pressure for stronger board accountability and capacity oversight. This figure rose from 44% to 58% in the Russell 3000.

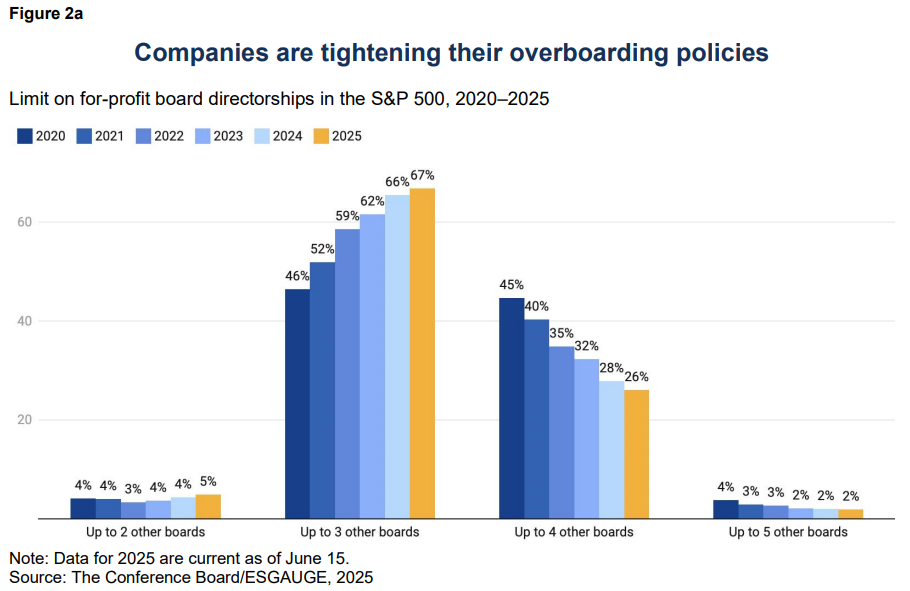

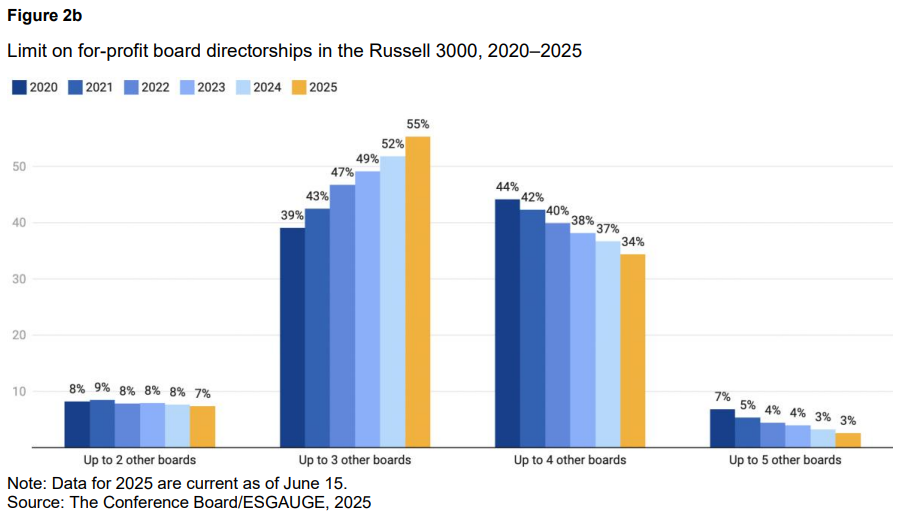

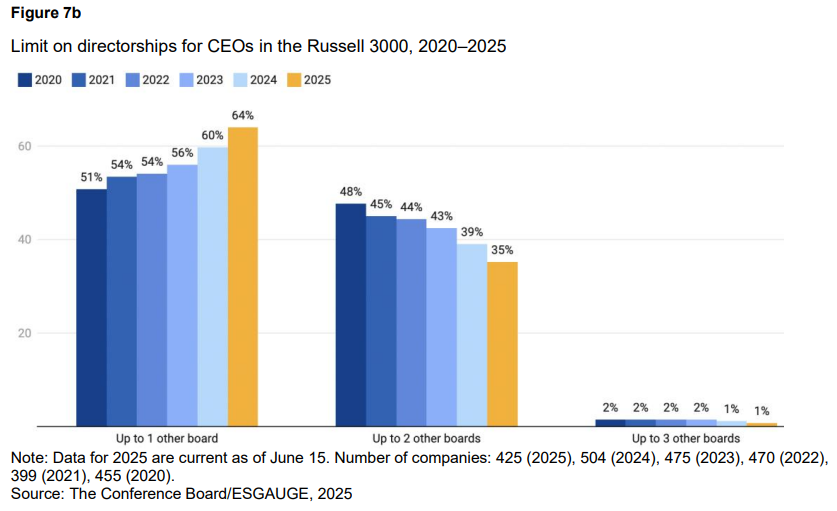

- Companies are moving toward stricter thresholds to align with evolving best practices: in 2020, 51% of Russell 3000 companies with an overboarding policy allowed directors to serve on up to four or five additional boards. By 2025, that figure had dropped to 37%, with 55% of companies now limiting directors from serving on more than three additional boards.

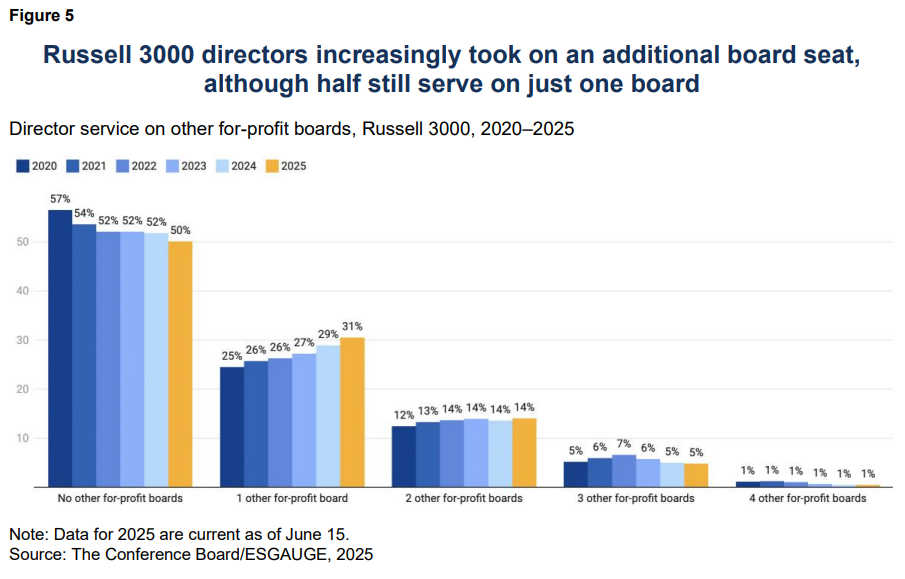

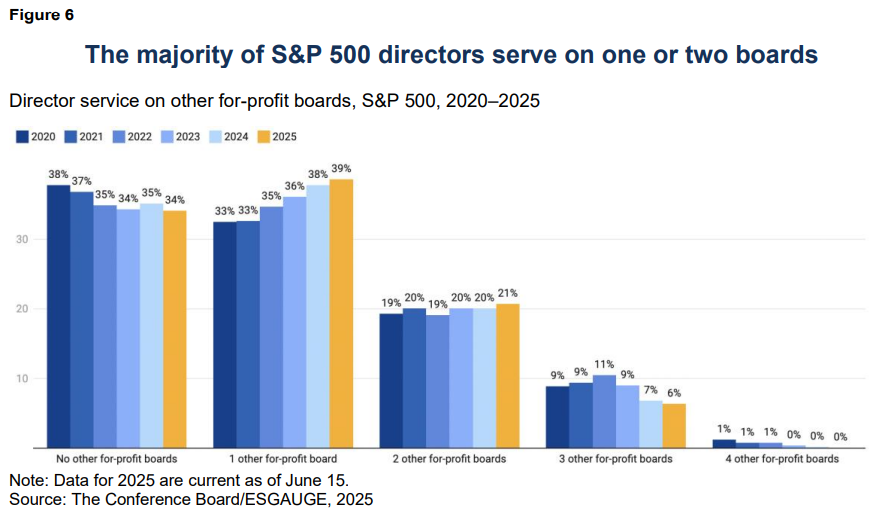

- While the number of directors serving on multiple boards has increased in recent years, the majority still serve on just one or two public company boards.

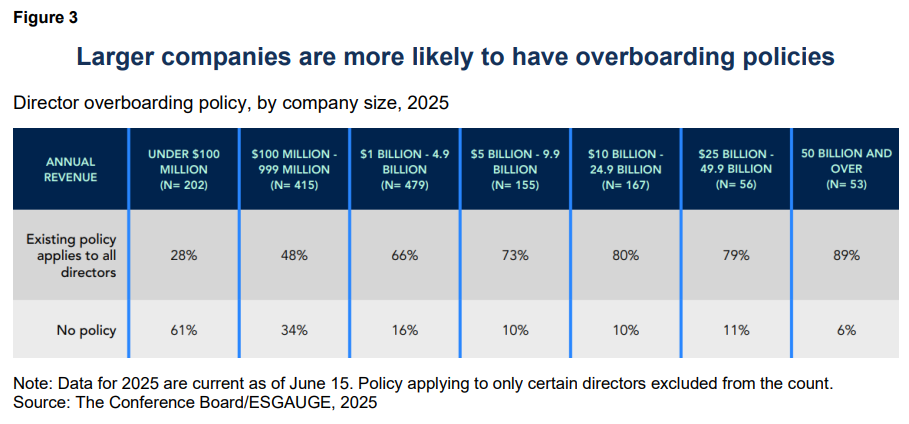

- The adoption of an overboarding policy is directly linked to company size and sector, with larger companies being more likely to have a policy that applies to all directors.

- Overboarding policies may promote board effectiveness and refreshment by helping ensure directors have sufficient capacity to fulfill their duties. However, since board service is a part-time role for nonemployee directors, overly rigid practices risk oversimplifying the factors that determine a director’s effectiveness and excluding highly qualified candidates with valuable experience.

Overboarding Policies and Board Refreshment

Overboarding policies—limitations on the number of boards on which a director may serve— have become increasingly prevalent among public companies as proxy advisors and institutional investors have incorporated director capacity limits into their voting guidelines. Notably, the adoption of overboarding policies increased by 26% in the S&P 500 and 32% in the Russell 3000 between 2020 and 2025.

These policies may be instrumental in enhancing board effectiveness and refreshment by ensuring directors have adequate capacity to fulfill their fiduciary responsibilities and by promoting turnover that allows for the introduction of new skills, perspectives, and diversity to corporate boards.

Such frameworks align with broader governance trends calling for boards to be more agile and responsive to evolving stakeholder expectations. In encouraging companies to regularly reassess their director pools to ensure directors have the necessary time to commit to each board seat, overboarding limits may help boards remain adaptable, improve succession planning, and maintain strategic relevance in an increasingly complex business environment.

From 2020 to 2025, the adoption of overboarding policies grew from 68% to 86% in the S&P 500, and from 44% to 58% in the Russell 3000, reflecting growing consensus among companies and investors that limiting board seats may support director capacity and effectiveness.

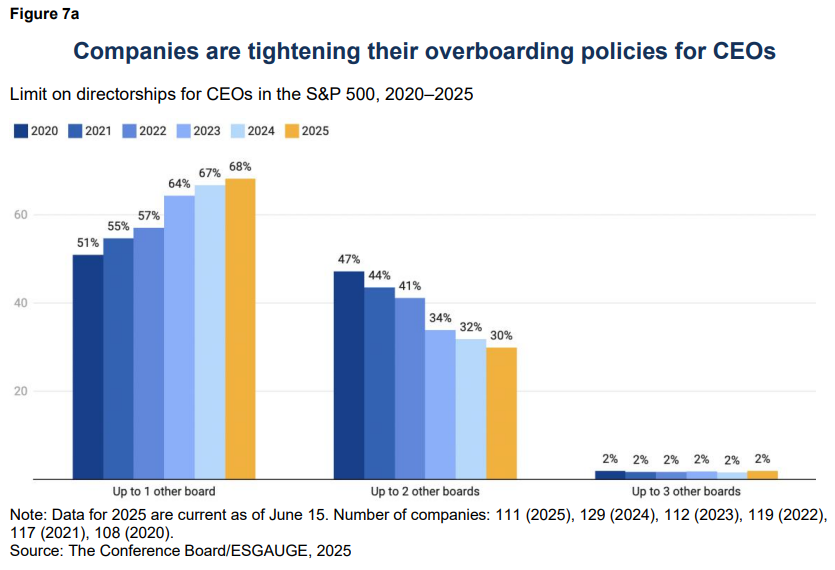

As the share of companies with overboarding policies has significantly increased in both the S&P 500 and Russell 3000, these policies most commonly limit directors from serving on more than three additional boards compared to up to four or five additional boards in previous years. This threshold reflects certain investor expectations and aligns with many proxy voting guidelines and emerging practices.

The adoption of a director overboarding policy is directly linked to company size, with larger companies being more inclined to have a policy that applies to all directors, whereas smaller companies (under $100 million in annual revenue) are more likely to have no policy at all (61%). As of June 2025, nearly 90% of companies with annual revenues of $50 billion and over disclosed a director overboarding policy that applies to all directors, with only 6% of companies in the same category having no policy at all.

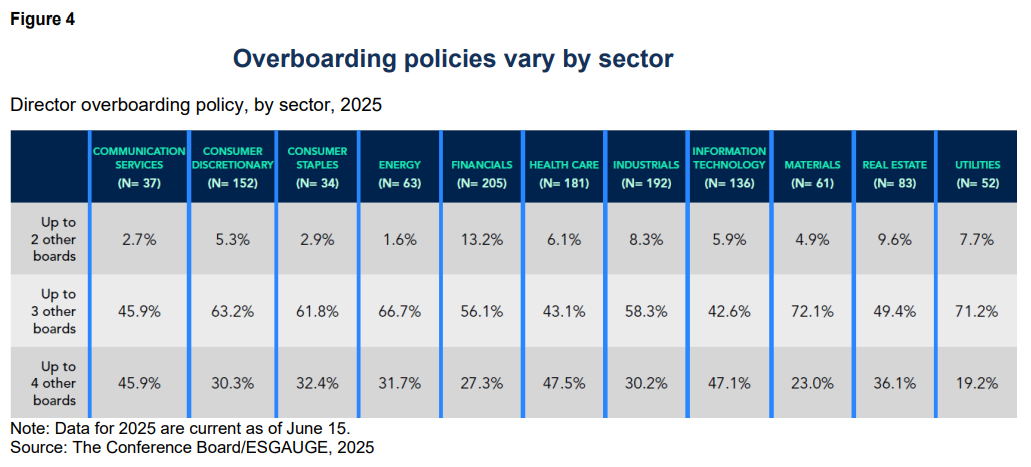

Overboarding policies vary by sector, with some industries taking a more rigid approach than others. Sectors like utilities (79%), materials (77%), and financials (69%) have the highest combined share of companies limiting directors to no more than two or three other board seats, while financials (13.2%), industrials (8.3%), and real estate (9.6%) stand out for having the highest percentages of companies imposing the strictest limit of two additional boards.

This likely reflects the higher time commitment necessary to operate under high regulatory scrutiny, operational complexity, and public accountability often associated with these industries:

- Utilities operate in highly regulated markets with significant federal and state oversight. Their boards are under constant scrutiny from regulators, investors, and the public on matters such as reliability, pricing, and sustainability.

- Industrials face high operational risks, complex global supply chains, and heightened exposure to safety, environmental, and regulatory challenges. Directors in this sector must also navigate shifting global trade dynamics, tariffs, and geopolitical disruptions.

- Financials are among the most heavily regulated sectors, particularly for large banks and systemically important institutions. Boards must dedicate significant time to dealing with complex issues such as capital adequacy, cybersecurity, market volatility, and evolving compliance requirements.

- Real estate companies manage capital-intensive portfolios that are sensitive to interest rate changes, regulatory developments, and broader macroeconomic trends.

- Materials companies often contend with substantial environmental and regulatory risks related to sourcing, production, and sustainability.

While the number of directors serving on multiple public company boards has increased in recent years, the majority still serve on just one or two boards. Directors at larger companies are also more likely to hold seats on other public company boards compared to those at smaller companies.

Balancing Overboarding Concerns

Despite their benefits, overboarding policies come with trade-offs as rigid numerical thresholds can risk oversimplifying a nuanced issue. Directors with multiple board commitments— especially those with cross-sector or international exposure—often bring valuable insights, facilitate knowledge transfer, and may help foster innovation. Blanket restrictions may inadvertently exclude highly capable candidates who are fully able to manage their responsibilities effectively.

Another concern is the loss of institutional knowledge and leadership continuity when longserving directors are pressured to step down due to overboarding concerns. Evaluating a director’s effectiveness requires looking beyond the number of board seats they serve on—it is influenced by the director’s role (e.g., CEO, chair, committee leader), the complexity of the companies involved, time demands (particularly in times of crisis), and the director’s individual capability.

Board service is a part-time role for nonemployee directors, who often balance their duties alongside other professional, civic, and personal commitments. Given the wide variation in individual capacity, focus, and experience, a uniform limit on the number of public company boards a person may serve on is unlikely, by itself, to improve board effectiveness. Instead, a more nuanced evaluation of each director’s engagement and contribution is essential.

In fact, many companies, proxy advisors, and investors are adopting more tailored approaches to determine directors’ capacities and effectiveness. These may include:

- Stricter limits for executives or committee chairs;

- Market-specific thresholds;

- Qualitative assessments such as performance evaluations and attendance records; and

- Flexibility for directors who publicly commit to stepping down from other boards.

Disclosure also plays a key role. Investors increasingly expect boards—particularly nominating committees—to articulate how they assess director capacity and to disclose policies governing those assessments.

Overboarding Policies in Proxy Voting

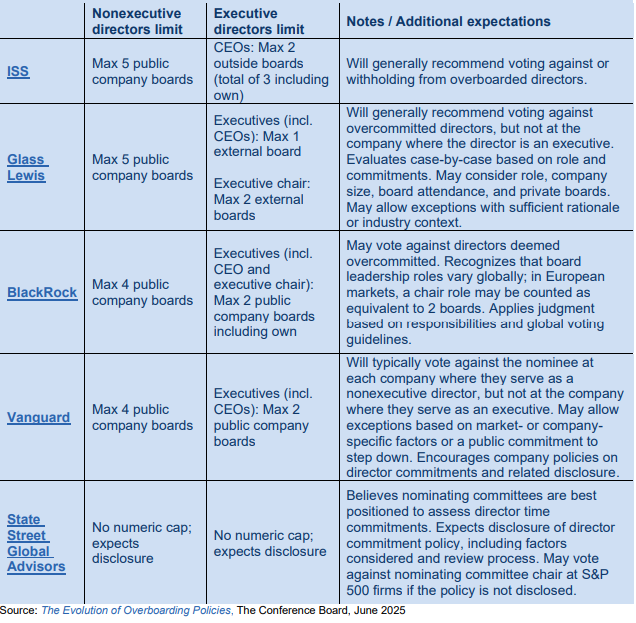

Overboarding policies from major asset managers and proxy voting advisors have evolved in response to growing concerns about director effectiveness, accountability, and board performance. Initially focused on setting broad thresholds, these policies have become more nuanced, reflecting increased expectations around director time commitments and governance transparency. While early approaches often relied on uniform limits, recent updates incorporate role-specific distinctions— particularly for public company executives—and call for greater disclosure rather than rigid caps.

The table below outlines the 2025 overboarding policies of key institutional investors and proxy advisors, highlighting how their approaches continue to adapt to evolving market norms and stewardship priorities.

Ultimately, a single approach to overboarding limits may undermine board performance by discouraging experienced, well-connected directors from contributing where they can add value.

Going forward, boards and investors might choose to embrace a more nuanced model—one that considers both quantitative thresholds and qualitative factors, such as a director’s role, performance, and engagement level. Policies should be transparent, dynamic, and sensitive to sectoral and regional differences.

The most effective governance structures will balance the need for fresh talent with the benefits of strategic continuity and director experience, ensuring that boards remain well-equipped to guide companies through today’s increasingly complex and interdependent business landscape.

This article is based on corporate disclosure data from The Conference Board Benchmarking Platform, Powered by ESGAUGE

Distribution channels: Education

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release